Briefly Explain the Difference Between Fixed Cost and Variable Costs

Fixed Costs Fixed costs remain the same in terms of their total dollar amount regardless of the number of units sold. The different examples of fixed costs can be rent salaries and property taxes.

Difference Between Fixed Costs And Variable Costs

The average variable cost initially falls as the output increases and later on it starts rising upward hence assumes the shape of U.

. The thing which makes these both distinct is the consistency and stability of costs with a period of time and the production level. Nature of Fixed Costs vs. At a per unit sales price of 12 revenue at our break-even point will be 120000.

Variable costs may include labor commissions and raw materials. Irrespective of the productivity or operations of a company these costs have to be borne by the business at all periods of time. Fixed costs are generally easier to plan manage and budget for than variable costs.

On the other hand the level of output has no effect on earnings in variable costs. Heres a look at the primary differences between fixed and variable costs. The variable cost per unit of activity is determined by dividing the change in total cost by the change in activity.

Cost is something that can be classified in several ways depending on its nature. Thus these both costs stand for every business enterprise. Thus fixed costs are incurred over a period of time while variable costs are incurred as units are produced.

Direct material direct labor and variable overhead are all variable costs. Unlike Variable Cost which is volume related ie. Variable costs are the sum of marginal costs over all units produced.

Impacted by production Fixed costs remain constant regardless of the level of output by the company. Taken together fixed and variable costs are the total cost of keeping your business running and making sales. The fixed cost is more or less an independent variable.

As a result of increased output expenses are reduced and profits are increased in fixed costs. Variable costs are costs that change as the quantity of the good or service that a business produces changes. It remains constant over a period.

Fixed costs remain the same regardless of production output. Variable costs change in direct proportion to. Distinguish between Variable Fixed and Mixed Cost Variable Cost.

It changes with the change in volume. These are general expenditures that cannot be traced to any one item sold and may include electricity insurance depreciation salary and rent expenses. Fixed and variable costs also have a friend in common.

Break-even quantity 100000 12 2 Our break-even quantity here is 10000 units. Variable Cost is the cost which varies with the changes in the number of production units. Semi-variable costs which share qualities of each.

Fixed costs are fixed for a specific period of time whereas the variable costs vary with the production. The contribution margin minus fixed costs equals net operating income. The total cost increasesdecreases as units made increasesdecreases.

Changes in total in direct proportion to changes in the level of activity. Businesses use fixed costs for expenses that remain constant for a specific period such as rent or loan payments while variable costs are for expenses that change constantly such as taxes labor and operational expenses. Fixed costs do not depend on the international market while a variable cost depends on.

Fixed cost includes expenses that remain constant for a period of time irrespective of the level of outputs like rent salaries and loan payments while variable costs are expenses that change directly and proportionally to the changes in business activity level or volume like direct labor taxes and operational expenses. When a cost contains elements of both fixed and variable costs it is considered a mixed cost. The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes.

Variable costs change based on the amount of output produced. In marketing it is necessary to know how costs divide between variable and fixed costs. Difference in total units 2900 1100 1800.

One of the most popular methods is classification according to fixed costs and variable costs. For our maintenance example we divide 2400 by 300 and determine that the variable cost per hour of maintenance is 800. The average fixed cost falls throughout and forms the shape of rectangular hyperbola.

Fixed costs are expenses that have to be paid by a company independent of any business activity. Average fixed costs fall with an increase in output whereas average variable costs fall less with the increase in output. Fixed costs are those costs that a company should bear irrespective of the levels of production.

Fixed costs are those costs that does not vary with changes in the quantity of output whereas variable cost is those costs that changes with the amount of output produced. You will know you have understood these two concepts well when you are able to differentiate between fixed and variable cost in a given set of data. Fixed Costs are a cost that does not change with an increase or decrease in the amount of goods or services produced.

The main difference is that fixed costs do not account for the number. Since the fixed cost component does not change with the number of sales the difference between the total costs of the month with the most units sold March and the month with the fewest units sold May will estimate variable costs. Fixed Cost is the cost which does not vary with the changes in the quantity of production units.

Above that point were making a profit and below were losing money. Fixed costs total fixed costs and variable costs all sound similar but there are significant differences between the three. Thanks Please share with your friends.

Fixed costs stay the same no matter how many sales you make while your total variable cost increases with sales volume. Your variable costs are 2 per unit with fixed costs of 100000. Difference in total cost 69800 48200 21600.

The Fixed cost is time-related ie. Fixed costs do not change with increasesdecreases in units of production volume while variable costs fluctuate with the volume of units of production. Fixed costs are considered within a relevant range.

Variable Costs Fixed costs are time-related ie they remain constant over a. Fixed costs are less controllable in nature than the variable costs as they are not dependent on the production factors such as volume. Fixed costs alter with the passage of a specific amount of time whereas as a result of the quantity created the variable cost varies.

Variable cost is constant if expressed on a per unit basis. Variable costs are the ones who change the way a company works while fixed costs are the people who stay constant throughout the whole process.

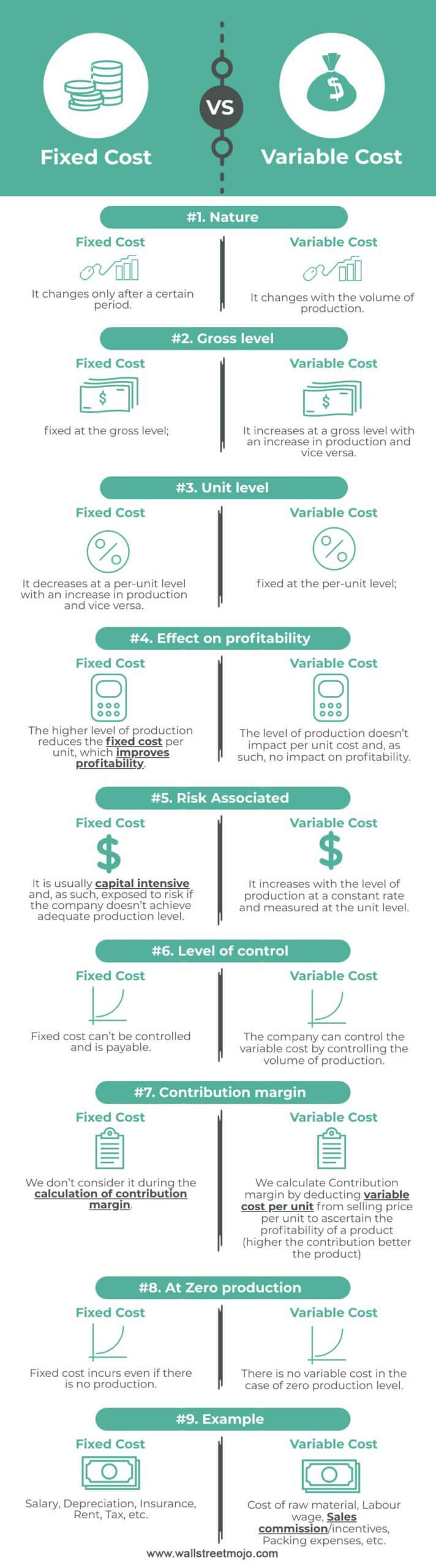

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

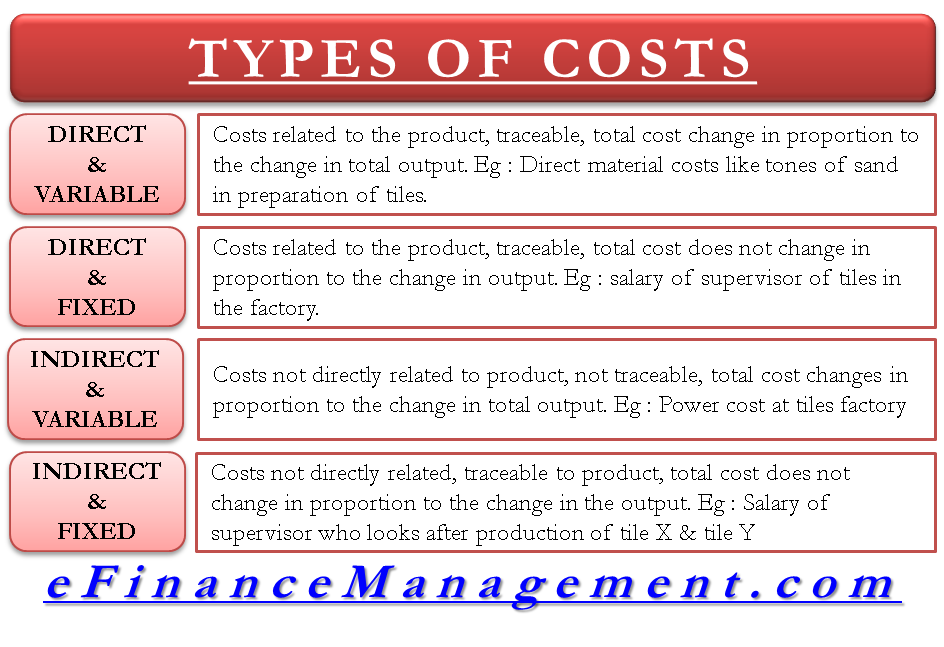

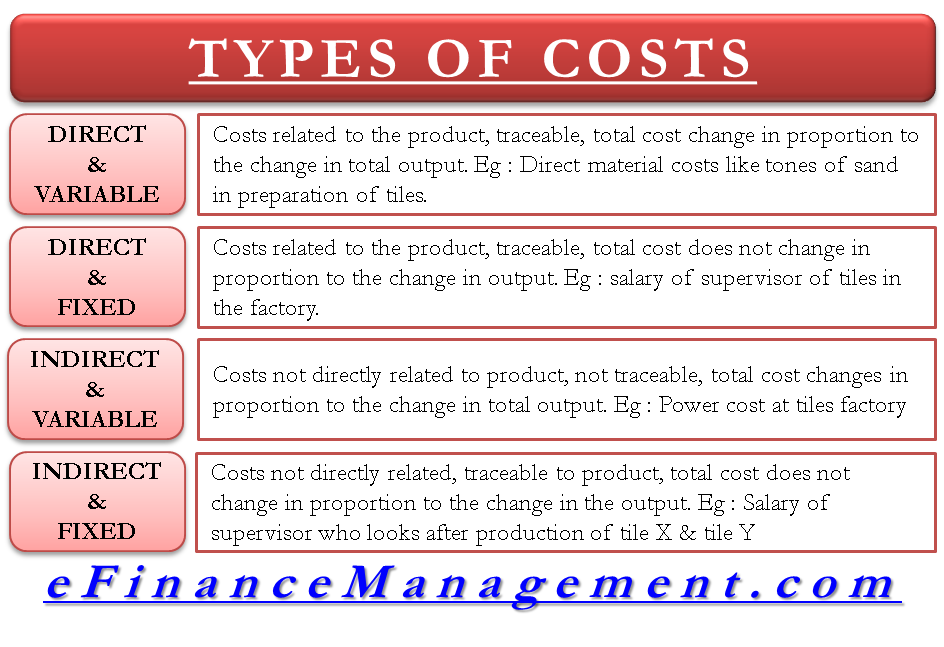

Types Of Costs Direct Indirect Costs Fixed Variable Costs Efm

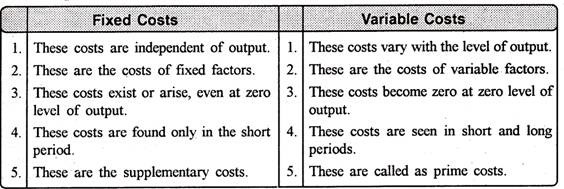

Difference Between Fixed Cost And Variable Cost With Example And Comparison Chart Key Differences

No comments for "Briefly Explain the Difference Between Fixed Cost and Variable Costs"

Post a Comment